FREQUENTLY ASKED QUESTIONS FAQ. On the Income Tax Office for the conveniences of general public.

How To Check Your Income Tax Number

For your IT150 log in to your account and then click on the Notice of registration icon on the Home page to see your account information.

. Select the e-Daftar icon or link from the drop-down menu. And enter your information. Type of File Number 2 alphabets characters SG or OG space Income Tax Number maximum 11 numeric characters Example.

The following is a list of Income Tax Office sorted by states. To check your income tax number go to httpsedaftarhasilgovmysemaknocukaiindexphp Choose your identification type New IC numberPolice ICArmy ICPassport number Key in the identification number of the selected identification type. On the e-Verify Return page enter your PAN select the Assessment Year enter Acknowledgment Number of the ITR filed and Mobile Number available with you and click Continue.

How can I obtain a Malaysian income tax identification number. Enter your MyKad number and Security Code in the appropriate fields on the website then click Hantar to continue. Step 2 E-payment.

You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready. TIN NSDL website is the official website of the Income Tax Department. How can I get my income tax number.

To see if you have already been assigned an Income Tax Identification Number go to Semak No. The most common tax reference types are SG OG D and C. FAQ On The Implementation Of Tax Identification Number.

To pay your back taxes select Challan 280 from the drop-down menu. If you do not have an income tax number yet please register for one either by. This is the final step.

Fill in the related information. Cukai Pendapatan Anda Terlebih Dahulu and enter your information. The Inland Revenue Board of Malaysia Malay.

03-8911 1000 Local number 03-8911 1100 Overseas number Not registered. Number is required 2 Only gif File Format is allowed and the file size must be from 40k and not more than 300k. Go to the e-Filing portal homepage and click e-Verify Return.

The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be implemented beginning year 2022 to broaden the income tax base. 3 File name must only contain Alphanumeric Characters a-z A-Z and 0-9. Step 3 Challan number 280.

Key in the security code displayed on the right side of the page. After logging in to the website select payment via FPX. Enter your MyKad number and Security Code as shown on the page and click Hantar.

TIN is the income tax number currently recorded by the Inland Revenue Board of Malaysia. SEMAKAN NO CUKAI PENDAPATANSYARIKAT MALAYSIACara Check Income Tax Number Online Sekiranya anda pembayar cukai sama ada individu atau syarikat yang telah berdaftar semestinya anda mempunyai nombor cukai pendapatan Malaysia. Fill in the Information.

If you do not have an Income Tax Identification Number but require one you should do the following. If you were previously employed you may already have a tax number. - Name and address of the receiver Foreign country of the receiver Receivers company registration number Passport number Date of birth of the receiver Type of payment Fill up information in e-TT Document submission.

For example the file numbers of individual residents and non-residents are SG and OG and the companys file number is C. Steps to check Income Tax Number. To check whether an Income Tax Number has already been issued to you click on Semak No.

You can request the issuance of the IT150 Tax reference number by sending an SMS to SARS on the number 47277 South African Revenue Service. Select ezHASiL from the drop-down menu. Nombor Cukai Pendapatan yang boleh digunakan untuk melakukan semua urusan dengan LHDNM atau.

To see if you have already been assigned an Income Tax Identification Number go to Semak No. SG 10234567090 or OG 25845632021 For individual ITN the end number can be either 0 or 1 which indicates the husband or wife. Cukai Pendapatan Anda Terlebih Dahulu.

Kad Pengenalan Baru tanpa simbol - seperti format berikut. Lembaga Hasil Dalam Negeri Malaysia classifies each tax number by tax type. How can I check my income tax return online.

The old registration system registers the wife with the same file number as the husband. This Income Tax Office info page is to provide information such as address telephone no fax no office hours and etc. E-Daftar is a website that allows you to register online.

Sila masukkan e-mel dan nombor telefon yang berdaftar dengan LHDNM untuk memaparkan nombor cukai pendapatan dan cawangan. Log in to your account. If no records are discovered that match your MyKad number click on the e-Daftar.

1Only the front of your Identity Card showing your name and Identification Card. The registration can be done by sending an email to HelpPendaftaranNRhasilgovmy The details in the email shall include. What is Tax Identification Number TIN.

Semakan Nombor Cukai Pendapatan Individu Lembaga Hasil Dalam Negeri Malaysia. Select the e-payment area from the drop-down menu. If no matched record is found against your MyKad number click on the e-Daftar link.

How can I check my income tax number online Malaysia. To register online go to the borang pendaftaran page. Visit the Inland Revenue Board of Malaysias official website for further information.

It has about 100 branches including UTC nationwide. SG 12345678901 Tax Reference Types. Your Income Tax Number consists of a tax reference type of 1 or 2-letter code followed by a 10 or 11-digit tax reference number.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

7 Tips To File Malaysian Income Tax For Beginners

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To Pay Your Income Tax In Malaysia

Individual Income Tax In Malaysia For Expatriates

Cukai Pendapatan How To File Income Tax In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To File Your Taxes For The First Time

Tips For Income Tax Saving L Co Chartered Accountants

7 Tips To File Malaysian Income Tax For Beginners

.png)

How To Check Your Income Tax Number

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

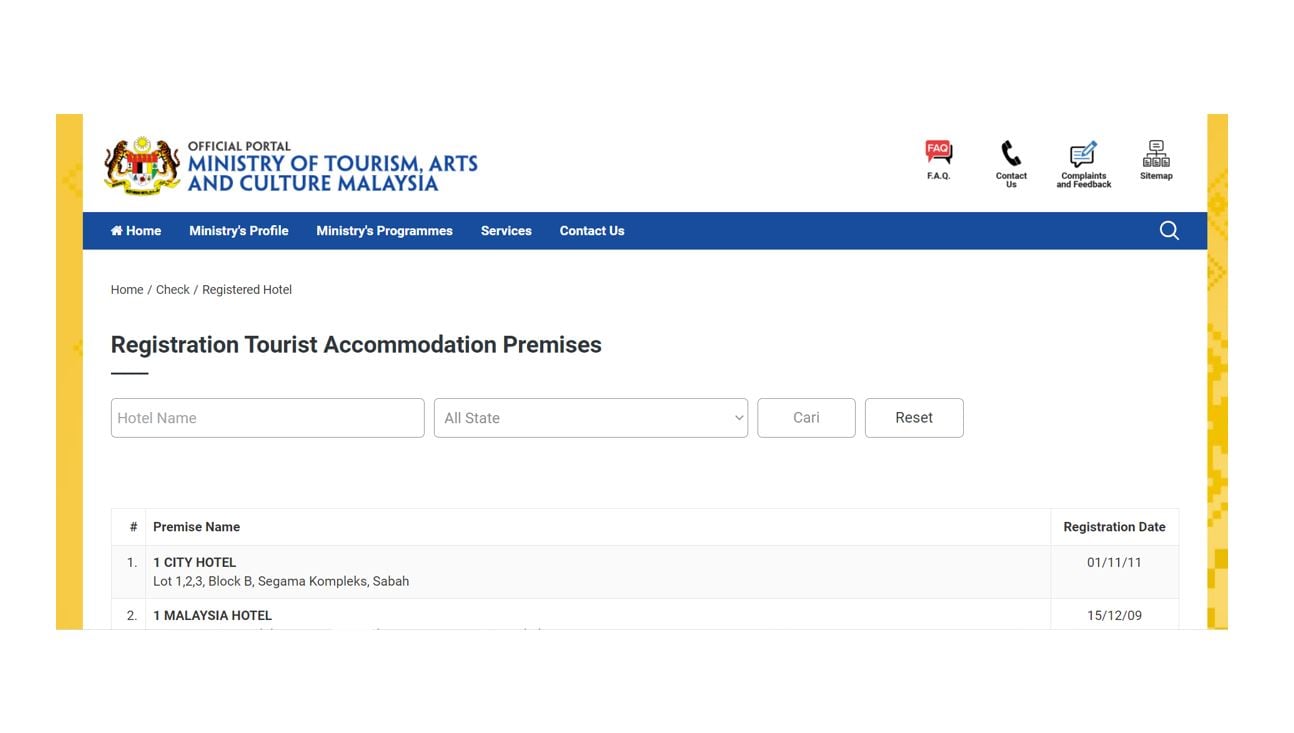

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Step By Step Income Tax E Filing Guide Imoney